Guest post from Jaime Atienza of Oxfam Intermon

Here we go again. Though different to their “first debt crisis”, which was incubated in the 80s, hit in the 90s and was resolved (partly) in the 2000s, the situation is again profoundly uphill for a growing number of African countries: in 2019 their debt repayments as a percentage of revenues will be higher than in 2001 – before the last round of debt relief.

The HIPC initiative was the response to that first debt crisis, with the IMF and the WB for the first time in their history writing off their own debts – and rich Western countries picking up the bill.

African countries were expected to build up their economies with the space gained from debt relief, benefiting from increased access to finance, especially private. That has in fact been the case since 2008 – 2009. For some countries, borrowing has been the easy path to finance development objectives, instead of raising tax collection, which is politically complicated. The positive cycle of money inflows kept growing until 2016-2017, as did the liabilities. But now it has stopped, and debt repayments are once again threatening to tip over into a debt crisis (graph by Tim Jones, Jubilee UK).

In the cycle that is now ending there have been two new main sources: private finance, coming from bank loans and bond emissions(Eurobonds) – these account for over a third of debt stock, but over half of current debt repayments;, and Chinese financing of different forms ultimately linked to big infrastructure investments (up to 20% of debt stocks, according to Jubilee UK). Multilateral financing has remained stable and diversified during the period.

Africa of course needs much more than finance to get onto a sustainable economic track: solid, respectable and well-functioning public institutions and regulatory systems, improved public health, quality education for girls and boys, increased private investment, sound tax policies that collect enough and provide the state with growing public investment, a system of checks and balances, an active and empowered civil society, enhanced transparency…

In terms of financing, the key resides in striking the balance between solid earnings from trade, increased tax collection (the most relevant), new financing from different sources (ie debt) and stable aid inflows.

So where are we in 2019?

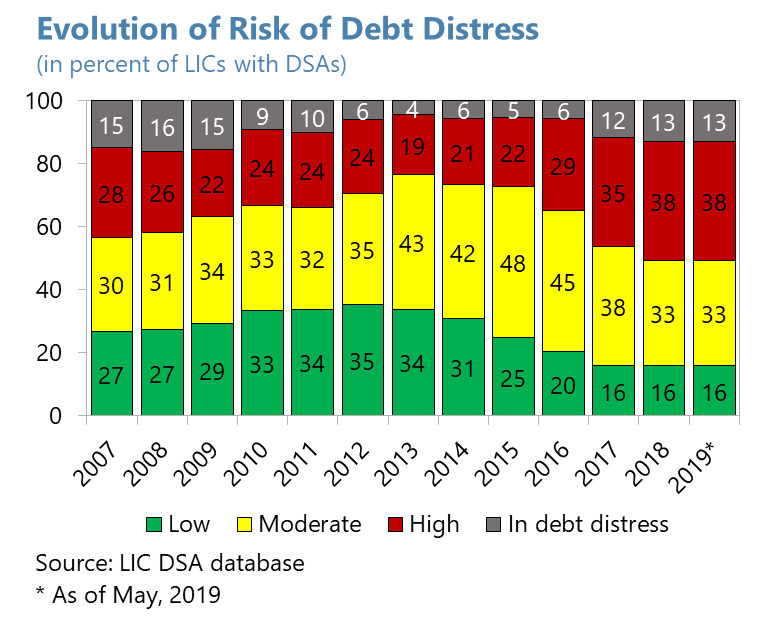

As of April 2019, according to the IMF, half of African Low Income Countries (LICs) are either in debt distress or at high risk of being so. Transparency gaps suggest stocks are significantly higher than accounted for, so the problem is worse than officially noted.

Debt repayments are now so high that they are squeezing out social investments, undermining the fight against poverty and inequality. With commodity prices very low, interest rates growing and exchange rates falling, less money on worse conditions is now arriving in Africa: the net flow is still positive but clearly declining. Eurobond calendars show that repayments will peak in 2020 – 2022, so those years will be harsher for many countries. Even countries at only moderate risk of debt distress are heavily cutting social spending (Kenya’s debt repayments as a proportion of its revenues tripled in 2 years, while in Uganda´s 2019/20 budget , interest payments will be the second largest expenditure – with spending on key sectors (health, education, and agriculture) cut by 12%).

So yes, Africa is facing a serious crisis. Avoiding a cascade of defaults is a priority to avoid a long economic crisis driven by debt, with a devastating human impact – some have already defaulted on particular loans or operations. This happens at a time of high population growth, severe climate impacts and already historically high population displacement.

Debt cancellation alone is not the answer…

The automatic reaction is to call for massive debt cancellation, as we did 20 years back. But while that was a necessary call, and some countries do need a total write off – e.g. Somalia – the priority now should be ensuring long-term financing on conditions that don’t undermine sustainable social development and economic growth. That means growing the tax base and tax collection (which requires rich economies pushing back on the use of tax havens by their companies), plus ensuring flows that don’t put an extra burden on already vulnerable economies. For that purpose, concessional flows are badly needed, especially aid.

Debt restructuring (calendars, interest rates, new financing, moratoria) will be needed and in some cases straight debt cancellation may have to be part of the solution. Increased transparency and responsible lending and borrowing are needed, but at this point are not enough. An all-actors-included debt resolution system, forum or mechanism is needed to provide a fair system when crises pop-up – currently debtor countries are powerless when negotiations happen.

All actors, African Governments first, but also IFIs, private actors and other governments should share responsibility to prevent Africa from slipping into a lost decade. The alternative is a cascade of defaults that will then lead to a new “HIPC III”, with African people suffering the most while creditors take heavy losses. We are running out of time. The diagnosis coming from different institutions is consistent: there is a serious debt problem today in Africa. But no one seems moved to take action, with most recommendations falling on the long-term prevention side: letting time pass will only aggravate the problem.