Following yesterday’s post introducing Oxfam’s new Davos Report, one of its authors, Max Lawson, reflects on the links between inequality and public services like health and education

Imagine having 25 years more life. Imagine what you could do. Twenty-five years more to spend with your children, your grandchildren. In pursuing your hopes and dreams.

In Sao Paulo, Brazil, a person from the richest neighbourhood will on average live 25 years more than a person from one of the poorest areas. In Nepal, a child from a poor family is three times less likely to reach their fifth birthday than a child from a rich family. In Kenya, where I live, a girl from a rich family is 73 times more likely to continue her education beyond secondary school that a girl from a poor one.

Inequality between rich and poor is not primarily about having a bigger house or a faster car. It is about the impact on the things that really matter in life, and nothing matters more than how long you get to live.

The relationship between public services and economic and gender inequality is the core topic of our Davos paper this year. How inequality translates into brutally unfair health and education outcomes, and conversely the power public services can have in reducing the gap between rich and poor and between women and men.

We make particular use of the fantastic data available for most developing countries because of Demographic and Health Surveys, which disaggregate by wealth quintile.

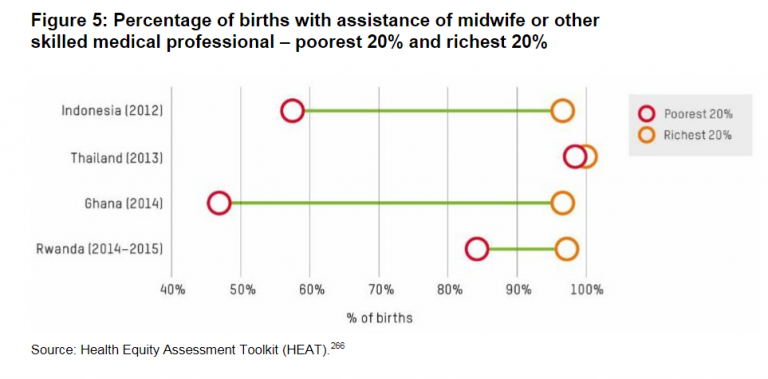

One of our findings is the huge variation between countries. As this graph shows, in Thailand and Rwanda, pregnant women from poor backgrounds can expect almost the same level of care as those from rich backgrounds, but the gap is enormous in countries like Ghana or Indonesia. Thailand is an amazing success story, delivering comprehensive universal public healthcare despite a per capita income the same as that in the U.S. in 1930.

The report opens with a foreword from Nellie Kumambala, a Malawian secondary school teacher, who I have known for 20 years. She is wonderful, and one of the many female public sector heroes showcased in the report.

All too often the World Bank and others seem to more consistently focus on lazy, absentee and ignorant public sector workers. I have long thought that this was deeply unfair, and the heroic job being done by most teachers, doctors and nurses around the world each day against huge odds should be shouted from the rooftops.

As the majority of the world’s teachers, doctors and nurses are women, denigrating them is sexist too. The report this year really seeks to go further than previous years in integrating a strong analysis of gender and economic inequality, and has a great section on unpaid care, and the role that public services can play in redistributing the billions of hours of unpaid work done by women each day.

The other barnstorming foreword in the report is from Nick Hanhauer, a billionaire who more than any other has spoken out against the dangers of extreme inequality, and the need for billionaires to pay more tax: ‘I have absolutely no doubt that the richest in our society can and should pay a lot more tax to help build a more equal society and prosperous economy…It is not a question of whether we can afford to do this. Rather, we cannot afford not to.’

He is not alone in calling for us to revisit the taxation of wealth. Our report opens with our usual analysis and killer facts on the mega-rich. The number and wealth of the world’s billionaires has almost doubled since the financial crisis, and last year was increasing by $2.5 billion a day. Meanwhile the World Bank has highlighted that the pace of reduction of extreme poverty (those living on less than $1.90 a day) has halved, and the number is rising in Africa.

One of my favourite facts this year is that just 1% of Jeff Bezos’ fortune is the equivalent of the whole health budget in Ethiopia. He is currently the richest man in the world, the first in history to have a fortune of over $100 billion. He recently gave an interview where he said he has decided to spend his fortune on space travel, as he can’t think of anything else to spend his money on. I am sure you would have several suggestions. We certainly do.

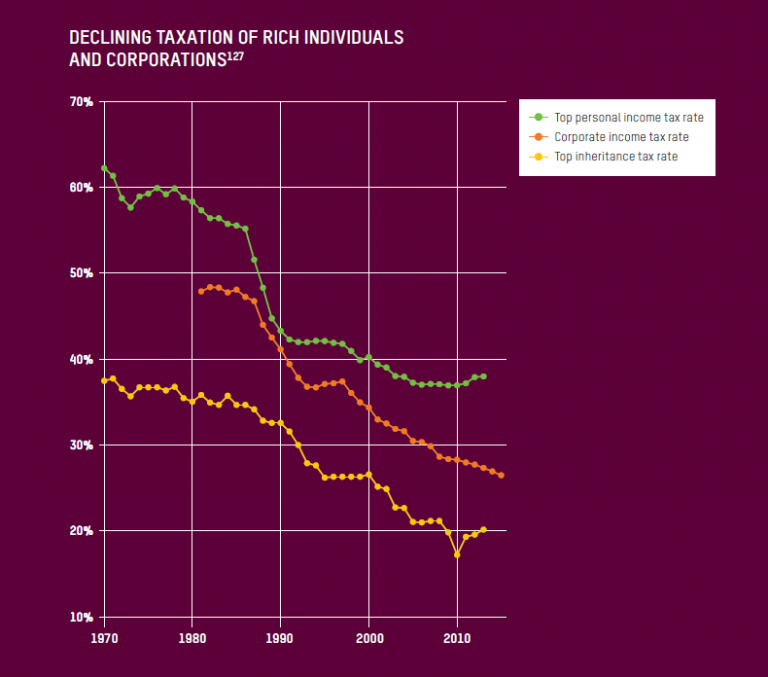

In the paper we join with the IMF, the Economist Magazine, Bill Gates and others in pointing out that wealth is structurally undertaxed, and there is a very strong case for increasing wealth taxes. Tax rates on the richest are the lowest they have been in decades in many countries. In developing countries the average top rate of personal income tax is just 28% and the top rate of corporate tax just 25%. Only 4 cents in every dollar of tax income comes from taxes on wealth. We calculate that if the richest 1% in each country paid an additional 0.5% of tax on their wealth, it would raise more money than it would cost to educate all the 262 million children out of school and provide healthcare that would save over three million lives.

The Davos paper this year marks the first in a number looking at the power of universal public services in creating a more human economy, and how they can lead the fight against inequality. Your bank balance should never dictate how much your children learn or how long you live.