By Jamie Livingstone

This decade is seeing humanity divide apart.

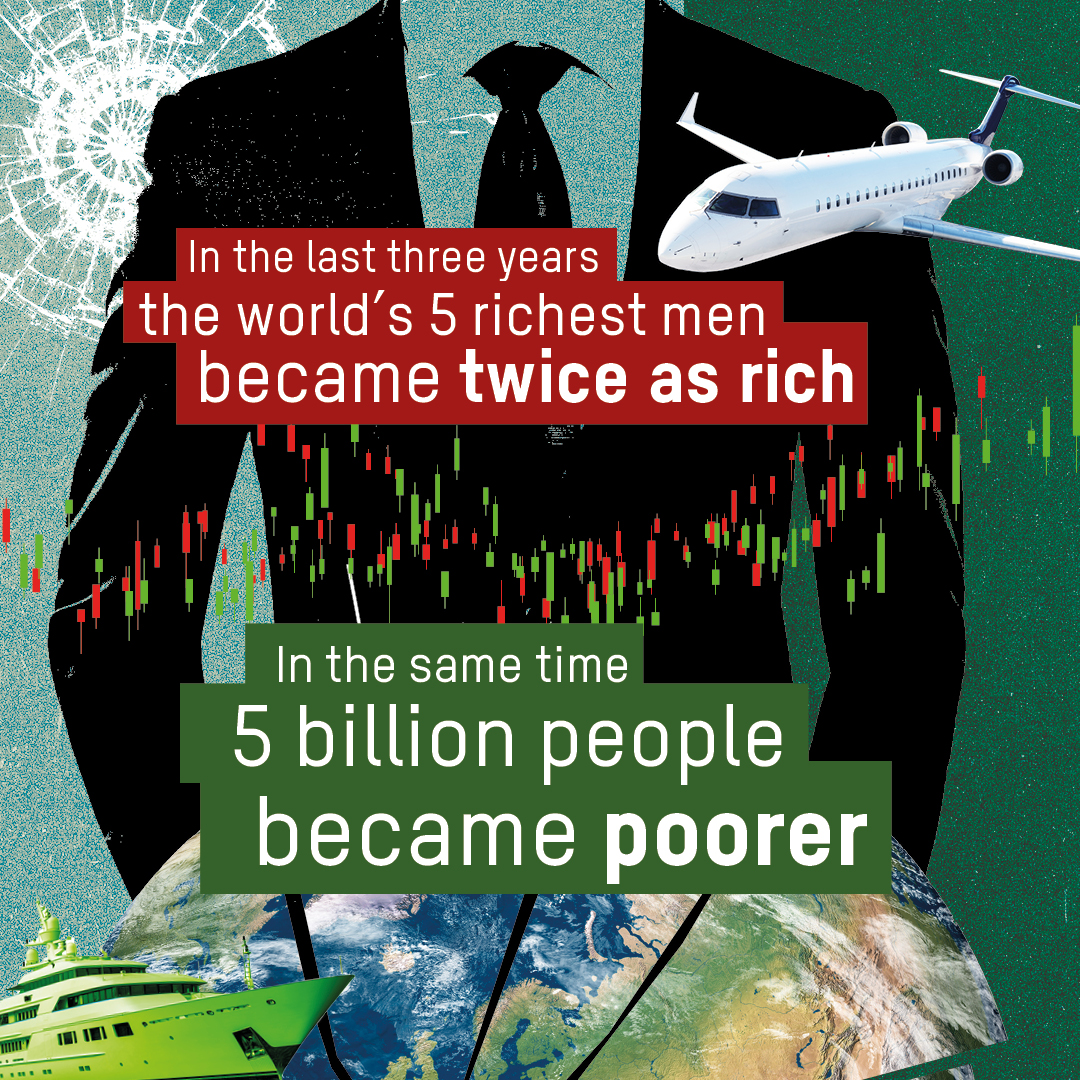

Today Oxfam’s explosive new report reveals that the world’s five richest men have more than doubled their fortunes since 2020, while five billion people have been made poorer.

At current rates we’ll see the first trillionaire within a decade, while it’ll take over two centuries to end poverty. A new economic aristocracy is rising, while billions of people are shouldering the shockwaves of poverty, hunger and war.

Our report, Inequality Inc., comes as governments, business leaders, and billionaires gather for the World Economic Forum in the Swiss resort town of Davosagainst a backdrop of extreme inequality that’s both unprecedented and morally unacceptable.

The ever-widening gulf between the rich and the rest isn’t accidental, nor inevitable. Governments worldwide are making deliberate choices that enable and encourage this distorted concentration of wealth, while hundreds of millions of people live in poverty.

A fairer economy is possible, one that works for us all. But to deliver it, we need concerted policies that deliver fairer taxation and support for everyone.

And while Oxfam’s new analysis is global, that’s also true across the UK, including in Scotland, where wealth inequality is also yawning.

According to the most recent Sunday Times rich list, there are 10 billionaires who either live in or have close ties to Scotland and have a combined fortune of more than £23 billion. Their extraordinary wealth contrasts with nearly a quarter of children in Scotland growing up in poverty.

Failing to tackle such deep unfairness is inexcusable.

With important powers reserved to Westminster, Oxfam is calling for the UK Government to introduce a new wealth tax on British millionaires and billionaires. Set at a rate of between one to two per cent on net wealth above £10 million, this could generate £22 billion each year to invest in public services and the green transition – some of this money would undoubtedly flow to Scotland.

However, the Scottish Government doesn’t need to wait; it can use devolved tax powers to raise more money while supporting its own goal of sharing wealth more evenly.

The imperative is clear, with wealth inequality in Scotland having widened in recent years; our richest 10% of households have, on average, 217 times more wealth than the poorest 10%.

In the Scottish Budget, Ministers made some fair changes to Income Tax, but these will do nothing to tackle wealth inequality, and are instead focused on short-term sticking-plaster solutions to fill budgetary black holes.

The Scottish Government’s upcoming tax strategy, due in the spring, must therefore be more ambitious and kickstart common sense tax reforms – including to better tax wealth.

Given that most wealth in Scotland is held in property, the obvious place to start is with Council Tax. Instead of persisting with a misguided rates freeze next year, Minister should launch a cross-party process to replace this deeply unfair tax before the end of this Parliament.

A more equal world is possible. But to build it, we must bridge the wealth divide.